Insurance scores have become an integral part of how insurance companies assess risk and determine premiums for various policies. While the term may sound daunting, understanding what an insurance score is, its purpose, and how it works can help consumers make informed decisions about their insurance needs. In this comprehensive guide, we will explore the definition of an insurance score, its components, its significance in the insurance industry, and examples to illustrate its impact.

What Is an Insurance Score?

Definition

An insurance score is a numerical representation of a person’s risk profile based on various factors, primarily derived from their credit history. Insurance companies use these scores to help determine how likely a policyholder is to file a claim and, consequently, how much they should charge for premiums. The score typically ranges from 200 to 997, with higher scores indicating a lower risk to the insurer.

How Is an Insurance Score Calculated?

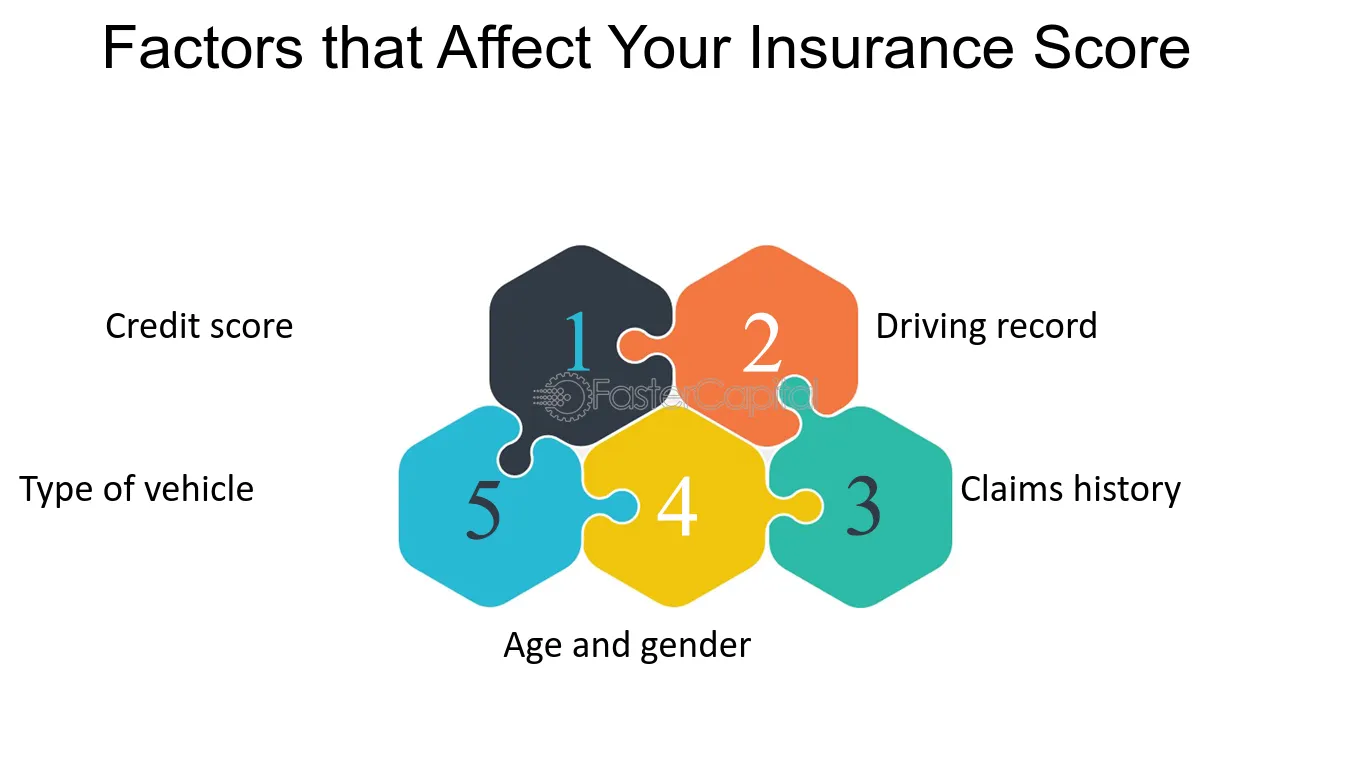

Insurance scores are calculated using a combination of data points, often sourced from an individual’s credit report and other relevant information. Some of the key factors that influence an insurance score include:

- Payment History: This includes the timeliness of bill payments and any past delinquencies or defaults.

- Credit Utilization: The ratio of credit used to total available credit can indicate financial responsibility.

- Length of Credit History: A longer credit history may positively impact the score, showing stability.

- Types of Credit: A mix of credit types (credit cards, mortgages, etc.) can contribute to a better score.

- Recent Credit Inquiries: Multiple inquiries for credit in a short period can negatively impact the score.

Differences Between Credit Scores and Insurance Scores

While both credit scores and insurance scores utilize similar data, they serve different purposes. Credit scores are primarily used by lenders to assess an individual’s ability to repay loans, while insurance scores are specifically tailored to evaluate the risk associated with insuring a person. As a result, the weight given to each factor can vary significantly between the two scoring models.

Purpose of an Insurance Score

Risk Assessment

The primary purpose of an insurance score is to evaluate the risk associated with insuring an individual. Insurance companies aim to minimize their potential losses, and having a reliable risk assessment tool helps them achieve that goal. By analyzing historical data, insurers can better predict which policyholders are more likely to file claims.

Premium Determination

Insurance scores play a crucial role in determining premiums. Generally, individuals with higher insurance scores are considered lower risk and are offered lower premiums, while those with lower scores may face higher costs. This practice allows insurers to set prices that are commensurate with the risk they assume.

Fraud Prevention

Insurance scores can also help in identifying potential fraud. A significantly low insurance score may raise red flags for insurers, prompting them to investigate the application further. This proactive approach can help reduce fraudulent claims and protect both the insurer and honest policyholders.

The Components of an Insurance Score

To better understand how an insurance score is derived, let’s delve into the various components that contribute to the overall score.

1. Credit History

Credit history is a substantial factor in calculating insurance scores. This includes records of all credit accounts, such as credit cards, loans, and mortgages. Insurers analyze how consistently a consumer has made payments and whether they have any bankruptcies, foreclosures, or collections in their history.

2. Credit Utilization Ratio

The credit utilization ratio measures how much of a person’s available credit is being used. A lower ratio is typically seen as favorable, indicating that the individual is not over-relying on credit. For example, using 30% or less of total available credit is often viewed positively.

3. Length of Credit History

The length of credit history accounts for the age of a consumer’s oldest account and the average age of all accounts. Longer histories may suggest responsible credit management, contributing positively to the insurance score.

4. Types of Credit Accounts

Having a diverse mix of credit accounts (installment loans, revolving credit, etc.) can be beneficial. Insurers may view this as a sign of financial responsibility, which can positively impact the insurance score.

5. Recent Inquiries

When a consumer applies for new credit, it can lead to hard inquiries, which may lower their credit score temporarily. Insurers consider the number of inquiries in recent months to assess the potential risk associated with the applicant.

How Insurance Scores Affect Insurance Premiums

Premium Pricing Models

Insurance companies utilize various pricing models to set premiums, and insurance scores are a critical element. The way an insurer calculates premiums may vary, but generally, the following principles apply:

- Higher Scores = Lower Premiums: Individuals with higher insurance scores are often rewarded with lower premiums because they are perceived as less risky.

- Lower Scores = Higher Premiums: Conversely, individuals with lower insurance scores may face higher premiums, reflecting the increased risk associated with insuring them.

Example Scenario

To illustrate how insurance scores influence premiums, consider two individuals:

- Alice has an insurance score of 750. Her credit history shows timely payments, a low credit utilization ratio, and a mix of credit types. As a result, she qualifies for a premium of $1,000 per year for her auto insurance policy.

- Bob has an insurance score of 550. His credit history includes late payments and high credit utilization. Because of his perceived risk, his premium for the same auto insurance policy is set at $1,500 per year.

In this example, Alice benefits from her strong insurance score, while Bob faces higher costs due to his lower score.

The Impact of Insurance Scores on Different Types of Insurance

Auto Insurance

Insurance scores play a significant role in determining auto insurance premiums. Insurers analyze drivers’ credit histories along with their driving records. Those with good credit often enjoy lower premiums, whereas those with poor credit may pay more, even if they have a clean driving history.

Homeowners Insurance

For homeowners insurance, insurance scores are also essential. Insurers evaluate the homeowner’s credit history and risk factors associated with the property. A high insurance score may lead to lower premiums, making it more affordable to maintain homeowner coverage.

Renters Insurance

Though not as heavily weighted as auto or homeowners insurance, insurance scores can still impact renters insurance premiums. Insurers use these scores to determine the risk of theft or damage claims, which can affect overall pricing.

How to Improve Your Insurance Score

Improving an insurance score can lead to better insurance rates, making it worthwhile for consumers to take proactive steps. Here are some effective strategies:

1. Pay Bills on Time

Consistently making payments on time is one of the best ways to improve your insurance score. Set up reminders or automatic payments to ensure you never miss a due date.

2. Reduce Credit Card Balances

Maintaining a low credit utilization ratio is crucial. Aim to keep your credit card balances below 30% of your total credit limit. Paying off existing balances can significantly enhance your insurance score.

3. Avoid Opening Multiple New Accounts

While it’s essential to have a mix of credit types, opening several new credit accounts in a short period can negatively impact your score. Be strategic about applying for new credit and limit inquiries.

4. Review Your Credit Report

Regularly check your credit report for inaccuracies or errors. Dispute any inaccuracies with the credit bureau to ensure your report reflects your true financial history.

5. Limit Hard Inquiries

Be mindful of how often you apply for new credit. Each hard inquiry can lower your score, so consolidate your applications into a shorter time frame if possible.

Common Misconceptions About Insurance Scores

1. Insurance Scores Are the Same as Credit Scores

Many consumers confuse insurance scores with credit scores. While they share some similarities, they are calculated differently and used for different purposes.

2. Only Bad Credit Affects Insurance Scores

While a poor credit history can negatively impact an insurance score, having good credit does not guarantee a high score. Other factors, like the length of credit history and credit mix, also play significant roles.

3. Insurance Companies Are the Only Ones That Use Insurance Scores

Although primarily used by insurance companies, insurance scores can also influence other areas, such as rental applications. Landlords may check an applicant’s insurance score to assess risk.

Conclusion

Understanding insurance scores is essential for consumers seeking insurance coverage. By comprehending the definition, purpose, and calculation of insurance scores, individuals can make informed decisions that impact their premiums and overall financial health. As the insurance landscape continues to evolve, being aware of how to improve and maintain a healthy insurance score will empower consumers to secure the best possible rates on their policies.

In 2024 and beyond, consumers should take charge of their financial narratives, ensuring their credit histories and insurance scores reflect their responsible behavior. By doing so, they can navigate the complex world of insurance with confidence and awareness, ultimately leading to better financial outcomes.